108 Market Sizing & Consumer Survey Charts

16 Company Profiles

4 Product Categories + Sales Channel Analysis

Raw Data + PPT Slides

Table of Contents

Click through each tab for an overview of each chapter and its data charts and survey questions.

Download the Table of ContentsExecutive Overview

- Key highlights and takeaways from the report. For example:

WEIGHTING ON PHARMA: Much of the chatter in the Sports Nutrition and Weight Management markets in 2024 isn’t really about nutrition at all. Drugs like Ozempic and Wegovy have transformed how Americans view weight management, and there’s no escaping the fact that some of that dynamic will wash over sports nutrition as well. The biggest share of the fitness faithful is likely more focused on losing weight and staying thin than they are on getting faster or bigger. At this point, the answer for weight management brands is complementing and aligning with pharma. The answer for sports nutrition is less clear, but smart brands will be looking for one.

- Top reasons for consistent use of sports nutrition or active lifestyle products

- Top health support claims consumers seek for sports performance products

- $69.86 billion U.S. sports nutrition and weight management industry by category, 2023

- U.S. sports nutrition and weight management sales and growth, 2019-2027e

- U.S. sports nutrition and weight management sales by category, 2019-2027e

- U.S. sports nutrition and weight management growth by category, 2019-2027e

- U.S. sports nutrition and weight management market share by category, 2019-2027e

- U.S. sports nutrition and weight management added dollars by category, 2019-2027e

- Where most consumers are participating in physical activity

- Why consumers take meal replacement or weight management supplements

- Weight-loss targets among weight loss supplement consumers

- Product categories consumers frequently use to support their sports or active lifestyle performance

- How the pandemic changed consumer activity levels

- Preferred format for hydration products

Functional beverages and bars

- Key highlights and takeaways from the report. For example:

THE AISLES HAVE IT: Many functional sports beverage consumers have always been looking for convenience over sports performance, and that shows up in where they choose to buy these products. A year ago, NBJ predicted some notable slowing growth for the category, but better prospects in mass market retail have buoyed the category, taking some of the sting out of what had looked like a weaker outlook.

- Sugar substitutes sports nutrition consumers are avoiding

- Sports nutrition functional beverages vs. Total sports nutrition and weight management sales and growth, 2019-2027e

- Sports nutrition functional beverages sales and growth, 2019-2027e

- $1.39 billion sports nutrition functional beverage market share by channel, 2023

- Sports nutrition functional beverage sales by channel, 2019-2027e

- Sports nutrition functional beverage growth by channel, 2019-2027e

- Nutrition bars and gels vs. Total sports nutrition and weight management sales and growth, 2019-2027e

- Nutrition bars and gels sales and growth, 2019-2027e

- $5.9 billion nutrition bars and gels sales by channel, 2023

- Nutrition bars and gels sales by channel, 2019-2027e

- Nutrition bars and gels growth by channel, 2019-2027e

- Jambar

- The Feel Bar Calm

- Snickers Hi Protein Low Sugar

- Else Plant-powered Complete Nutrition Shake Ready to Drink

- Suja Organic Protein Shakes

- Fairlife Nutrition Plan Shakes

Hydration and energy

- Key highlights and takeaways from the report. For example:

ONLINE OUTCOMES: Though both are growing exceptionally fast online, it’s worth noting how much faster Sports Hydration Beverage sales are growing than Sports Energy Beverage sales. In 2023, hydration grew at a blistering 15.8%, while energy drinks clipped along at 12.7%. Sports Energy is a much bigger market, which explains some of the difference, but there’s something remarkable going on with hydration as a new consumer priority.

- $46.39 billion sports hydration and energy beverage market share by channel, 2023

- Sports hydration and energy beverages sales and growth, 2019-2027e

- Sports hydration and energy beverages sales by channel, 2019-2027e

- Sports hydration and energy beverages growth by channel, 2019-2027e

- Sports hydration and energy beverages market share by channel, 2019-2027e

- Sports hydration and energy beverages vs. Total sports nutrition and weight management industry sales and growth, 2019-2027e

- $17.65 billion sports hydration beverage market share by channel, 2023

- Sports hydration beverages sales and growth, 2022-2027e

- Sports hydration beverage sales by channel, 2022-2027e

- Sports hydration beverage growth by channel, 2022-2027e

- Sports hydration beverage market share by channel, 2022-2027e

- Sports hydration beverages vs. Total sports nutrition and weight management industry sales and growth, 2022-2027e

- $28.74 billion sports energy beverage market share by channel, 2023

- Sports energy beverages sales and growth, 2022-2027e

- Sports energy beverage sales by channel, 2022-2027e

- Sports energy beverage growth by channel, 2022-2027e

- Sports energy beverage market share by channel, 2022-2027e

- Sports energy beverages vs. Total sports nutrition and weight management industry sales and growth, 2022-2027e

- Ka-Ex

- Coco5

- Blueshift Electrolytes

- Zola Organic Hydrating Energy Drinks

- Yerbae Plant-Based Energy Beverage

- Bang Energy

- Read more

Sports pills and powders

- Key highlights and takeaways from the report. For example:

PLANT-ING A FLAG: Plant-based protein, including rice, pea and other multiplant options, represents 40.6% of the sports nutrition powder market and 58% of the protein powder market, excluding the share of collagen marketed as protein. Pea, the star plant protein, is outpacing whey, the star animal-based protein.

- Sports nutrition pill, powder and gummy sales and growth, 2019-2027e

- Sports nutrition pills and gummies vs. Total sports nutrition and weight management sales and growth, 2019-2027e

- Sports nutrition pill and gummy sales and growth, 2019-2027e

- $422.1 million U.S. sports nutrition pill and gummy market share by channel, 2023

- Sports nutrition pill and gummy sales by channel, 2019-2027e

- Sports nutrition pill and gummy growth by channel, 2019-2027e

- Sports nutrition pill and gummy added dollars by channel, 2019-2027e

- Sports nutrition protein powders vs. Total sports nutrition and weight management sales and growth, 2019-2027e

- Sports nutrition protein powder sales and growth, 2019-2027e

- Sports nutrition protein powder sales by protein type, 2022-2027e

- Sports nutrition protein powder growth by protein type, 2022-2027e

- All other sports nutrition powder sales and growth, 2022-2027e

- All other sports nutrition powder sales, growth and market share 2022-2027e

- $7.92 billion U.S. sports nutrition powder market share by channel, 2023

- $7.92 billion U.S. sports nutrition powder market share by channel, 2023

- Sports nutrition powder sales by channel, 2019-2027e

- Sports nutrition powders growth by channel, 2019-2027e

- Sports nutrition powder added dollars by channel, 2019-2027e

- BodyTech Elite Hexatein-SR

- Bucked Up Pixie Pump

- Bucked Up Pixie Pump

Weight management

- Key highlights and takeaways from the report. For example:

PHARMA COATTAILS: At the dawn of the “Ozempic Age,” it was easy to assume that pills and meal replacements for weight management were doomed. That assumption looks less obvious today. Not only are companies like Abbott and Herbalife offering nutrient-dense meal replacement shakes for people to consume while they are on drugs like Ozempic, brands are also looking to support consumers as they cycle on and off the medications. The simple reality is that a pharma category that could grow to $100 billion by the end of the decade is going to have wide coattails, and smart brands will find a way to climb aboard.

- Product categories respondents currently take

- Weight management pill supplements vs. Total sports nutrition and weight management sales and growth, 2019-2027e

- Weight management pill supplements sales and growth, 2019-2027e

- $1.63 billion weight management pill supplement market share by channel, 2023

- Weight management pill supplements sales by channel, 2019-2027e

- Weight management pill supplements growth by channel, 2019-2027e

- Weight management pill supplements added dollars by channel, 2019-2027e

- Weight management meal supplements vs. Total sports nutrition and weight management sales and growth, 2019-2027e

- Weight management meal supplement sales and growth, 2019-2027e

- $6.17 billion weight management meal supplement market share by channel, 2023

- Weight management meal supplement growth by channel, 2019-2027e

- $6.17 billion weight management meal supplement market share by channel, 2023

- Weight management meal supplement added dollars by channel, 2019-2027e

- Culturelle Metabolism + Weight Management Capsules

- Supergut The Gut Balancing Chocolate Shake

- Steel Slim

- Protality Nutrition Shake

- Ample Complete Meal Shake

- CTRL Meal Replacement Shake Cookies N’ Cream

Sales channels

- Key highlights and takeaways from the report. For example:

MEAL PLAN: The MLM/ Network Marketing channel is increasingly dependent on Weight Management Meal Supplements for the scant growth it is seeing. Overall, sales for the channel were 3% in 2023, but sales climbed 3.6% for meal supplements. That growth is vital for the channel, with 42.7% of 2023 sales coming from the category. Combined with pills, weight management accounted for 60.2% of channel sales. That share has fallen in recent years, one of the more troubling signs for the multilevel sales model.

- Where consumers typically purchase sports nutrition products

- Sports nutrition functional beverage market share by channel, 2019-2027e

- $69.86 billion U.S. sports nutrition and weight management market share by channel, 2023

- U.S. sports nutrition and weight management sales by channel, 2019-2027e

- U.S. sports nutrition and weight management growth by channel, 2019-2027e

- $6.95 billion U.S. Natural and Specialty Retail sports nutrition and weight management market share by category, 2023

- U.S. Natural and Specialty Retail sports nutrition and weight management sales and growth, 2019-2027e

- U.S. Natural and Specialty Retail sports nutrition and weight management sales by category, 2019-2027e

- U.S. Natural and Specialty Retail sports nutrition and weight management growth by category, 2019-2027e

- U.S. Natural and Specialty Retail sports nutrition and weight management market share by category, 2019-2027e

- $52.1 billion U.S. Mass Market Retail sports nutrition and weight management sales by category, 2023

- U.S. Mass Market Retail sports nutrition and weight management sales and growth, 2019-2027e

- U.S. Mass Market Retail sports nutrition and weight management sales by category, 2019-2027e

- U.S. Mass Market Retail sports nutrition and weight management growth by category, 2019-2027e

- U.S. Mass Market Retail sports nutrition and weight management market share by category, 2019-2027e

- $3.50 billion U.S. MLM.Network Marketing sports nutrition and weight management market share by category, 2023

- U.S. MLM/Network Marketing sports nutrition and weight management sales and growth, 2019-2027e

- U.S. MLM/Network Marketing sports nutrition and weight management sales by category, 2019-2027e

- U.S. MLM/Network Marketing sports nutrition and weight management growth by category, 2019-2027e

- U.S. MLM/Network Marketing sports nutrition and weight management market share by category, 2019-2027e

- $5.67 billion U.S. E-commerce sports nutrition and weight management market share by category, 2023

- U.S. E-commerce sports nutrition and weight management sales and growth, 2019-2027e

- U.S. E-commerce sports nutrition and weight management sales by category, 2019-2027e

- U.S. E-commerce sports nutrition and weight management growth by category, 2019-2027e

- U.S. E-commerce sports nutrition and weight management market share by category, 2019-2027e

- $1.40 billion U.S. Practitioner and Fitness Club sports nutrition and weight management market share by category, 2023

- U.S. Practitioner and Fitness Club sports nutrition and weight management sales and growth, 2019-2027e

- U.S. Practitioner and Fitness Club sports nutrition and weight management sales by category, 2019-2027e

- U.S. Practitioner and Fitness Club sports nutrition and weight management growth by category, 2019-2027e

- U.S. Practitioner and Fitness Club sports nutrition and weight management market share by category, 2019-2027e

- $218.1 million U.S. Mail Order/DRTV/Radio sports nutrition and weight management market share by category, 2023

- U.S. Mail Order/DRTV/Radio sports nutrition and weight management sales and growth, 2019-2027e

- U.S. Mail Order/DRTV/Radio sports nutrition and weight management sales by category, 2019-2027e

- U.S. Mail Order/DRTV/Radio sports nutrition and weight management growth by category, 2019-2027e

- U.S. Mail Order/DRTV/Radio sports nutrition and weight management market share by category, 2019-2027e

Company profiles

- 1440 Foods

- Abbott Nutrition

- Beachbody (Shakeology)

- The Coca-Cola Company (including BodyArmor, Core Power, Powerade, Vitamin Water)

- BellRing Brands (including Premier Nutrition, PowerBar, Premier Protein)

- Gainful

- Glanbia (including Amazing Grass, Optimum Nutrition, SlimFast, Think!)

- GNC

- Herbalife Nutrition Ltd.

- Mondelez International, Inc. (Clif Bar & Company)

- Nestlé Health Science (including Atrium Innovations, Boost, Garden of Life, Klean Athlete, Persona, Pure Encapsulations, The Bountiful Company, Nuun, Orgain, Vital Proteins)

- Nutrabolt

- PepsiCo (including Amp, CytoSport, Gatorade, Propel)

- Red Bull

- Simply Good Foods (including Atkins, Quest Nutrition)

- Unilever (including Liquid I.V., Olly Nutrition, Onnit, SmartyPants)

Over 150 Data Charts

30 Company Profiles

22 Health Conditions Tracked

Raw Data + PPT Slides

Sales, growth, and analysis across these health conditions

General health

Women’s health

Men’s health

Children’s health

Gastrointestinal health

Liver health

Heart health

Healthy aging

Bone health

Joint health

Healthy sleep

Brain health

Mood and mental health

Vision

Beauty from within

Cold, flu and immunity

Pre- and postnatal

Menopause

Sexual health

Weight Management

Table of Contents

Download the Table of ContentsExecutive Overview

- Key highlights and takeaways from the report.

- Market share of top conditions, 2022

- Supplement sales by condition, 2018-2022

- Supplement sales by condition, 2023e-2026e

- Supplement growth by condition, 2018-2022

- Supplement growth by condition, 2023e-2026e

- Supplement market share by condition, 2018-2022

- Supplement market share by condition, 2023e-2026e

Beauty from within

- Key highlights and takeaways from the report.

- Beauty from within vs. total supplement sales and growth, 2018-2026e

- Beauty from within supplement sales and growth, 2018-2026e

- Top 6 beauty from within supplement ingredients by market share, 2022

- Beauty from within supplement sales by ingredient, 2018-2026e

- Beauty from within supplement growth by ingredient, 2018-2026e

- Beauty from within supplement sales, growth and market share by channel, 2020-2022

- Great Lakes Wellness Quick Dissolve Daily Beauty Collagen Peptides

- NeoCell Hair, Skin & Nails Beauty Builder Gummies

- OxyCeutics Gut to Glow

Bone health

- Key highlights and takeaways from the report.

- Bone health vs. total supplement sales and growth, 2018-2026e

- Bone health supplement sales and growth, 2018-2026e

- Top 6 bone health supplement ingredients by market share, 2022

- Bone health supplement sales by ingredient, 2018-2026e

- Bone health supplement growth by ingredient, 2018-2026e

- Bone health supplement sales, growth and market share by channel, 2020-2022

- Life Extension Bone Strength Collagen Formula

- Vital Proteins Bioactive Collagen Complex Bone and Joint Support

- Twinlab D3 1000 + K2 Dots

Brain health

- Key highlights and takeaways from the report.

- Brain health vs. total supplement sales and growth, 2018-2026e

- Brain health supplement sales and growth, 2018-2026e

- Top 6 brain health supplement ingredients by market share, 2022

- Brain health supplement sales by ingredient, 2018-2026e

- Brain health supplement growth by ingredient, 2017-2025e

- Brain health supplement sales, growth and market share by channel, 2020-2022

- Banyan Botanicals Focus Liquid Extract

- NOW Foods Triple Strength Astaxanthin

- Organifi Focus

Cold, flu and immunity

- Key highlights and takeaways from the report.

- Cold, flu, and immunity vs. total supplement sales and growth, 2018-2026e

- Cold, flu, and immunity supplement sales and growth, 2018-2026e

- Top 6 cold, flu, and immunity supplement ingredients by market share, 2022

- Cold, flu, and immunity supplement sales by ingredient, 2018-2026e

- Cold, flu, and immunity supplement growth by ingredient, 2018-2026e

- Cold, flu, and immunity supplement sales, growth and market share by channel, 2020-2022

- Aurora Nutrascience Liposomal Vitamin C

- Emergen-C Orange Support Immunity C

- LifeSeasons Clinical Immunity Quick-Start

Gastrointestinal health

- Key highlights and takeaways from the report.

- Gastrointestinal health vs. total supplement sales and growth, 2018-2026e

- Gastrointestinal health supplement sales and growth, 2018-2026e

- Top 6 gastrointestinal health supplement ingredients by market share, 2022

- Gastrointestinal health supplement sales by ingredient, 2018-2026e

- Gastrointestinal health supplement growth by ingredient, 2018-2026e

- Gastrointestinal health supplement sales, growth and market share by channel, 2020-2022

- Pendulum Butyricum

- Goli Nutrition Pre + Post + Probiotics Gummies

- NBPure Mag07

Women’s general health

- Key highlights and takeaways from the report.

- Women’s health vs. total supplement sales and growth, 2018-2026e

- Women’s health supplement sales and growth, 2018-2026e

- Top 6 women’s health supplement ingredients by market share, 2022

- Women’s health supplement sales by ingredient, 2018-2026e

- Women’s health supplement growth by ingredient, 2018-2026e

- Women’s health supplement sales, growth and market share by channel, 2020-2022

- MaryRuth’s Women’s 40+ Multi Liposomal

- Renew Life Women’s Care Gummy

- 1MD Nutrition BiomeMD for Women

Men’s general health

- Key highlights and takeaways from the report.

- Men’s health vs. total supplement sales and growth, 2018-2026e

- Men’s health supplement sales and growth, 2018-2026e

- Top 6 men’s health supplement ingredients by market share, 2022

- Men’s health supplement sales by ingredient, 2018-2026e

- Men’s health supplement growth by ingredient, 2018-2026e

- Men’s health supplement sales, growth and market share by channel, 2020-2022

- Iwi Men’s Complete Multi

- Friska Men’s Daily

- Centrum MultiGummies Men

Children’s general health

- Key highlights and takeaways from the report.

- Children’s health vs. total supplement sales and growth, 2018-2026e

- Children’s health supplement sales and growth, 2018-2026e

- Top 6 children’s health supplement ingredients by market share, 2022

- Children’s health supplement sales by ingredient, 2018-2026e

- Children’s health supplement growth by ingredient, 2018-2026e

- Children’s health supplement sales, growth and market share by channel, 2020-2022

- Hiyahealth Kids Daily Essential

- Smartypants Teen Guy Formula

- Nordic Naturals Children’s DHA

Healthy aging

- Key highlights and takeaways from the report.

- Healthy aging vs. total supplement sales and growth, 2018-2026e

- Healthy aging supplement sales and growth, 2018-2026e

- Top 6 healthy aging supplement ingredients by market share, 2022

- Healthy aging supplement sales by ingredient, 2018-2026e

- Healthy aging supplement growth by ingredient, 2018-2026e

- Healthy aging supplement sales, growth and market share by channel, 2020-2022

- Natural Factors PQQ-10

- Quiksilver Bio-Age Reversal

- Pure Encapsulations ResCu-SR

Healthy sleep

- Key highlights and takeaways from the report.

- Healthy sleep vs. total supplement sales and growth, 2018-2026e

- Healthy sleep supplement sales and growth, 2018-2026e

- Top 6 healthy sleep supplement ingredients by market share, 2022

- Healthy sleep supplement sales by ingredient, 2018-2026e

- Healthy sleep supplement growth by ingredient, 2018-2026e

- Healthy sleep supplement sales, growth and market share by channel, 2020-2022

- Neuriva Relax+Sleep

- Nue Co Sleep+

- Sandland Sleep Set

Heart health

- Key highlights and takeaways from the report.

- Heart health vs. total supplement sales and growth, 2018-2026e

- Heart health supplement sales and growth, 2018-2026e

- Top 6 heart health supplement ingredients by market share, 2022

- Heart health supplement sales by ingredient, 2018-2026e

- Heart health supplement growth by ingredient, 2018-2026e

- Heart health supplement sales, growth and market share by channel, 2020-2022

- HumanN SuperBeets Heart Chews

- Cardio Miracle

- Thorne Heart Health Complex

Liver health and detox

- Key highlights and takeaways from the report.

- Liver health and detox vs. total supplement sales and growth, 2018-2026e

- Liver health and detox supplement sales and growth, 2018-2026e

- Top 6 liver health and detox supplement ingredients by market share, 2022

- Liver health and detox supplement sales by ingredient, 2018-2026e

- Liver health and detox supplement growth by ingredient, 2018-2026e

- Liver health and detox supplement sales, growth and market share by channel, 2020-2022

- Gaia Herbs Liver Cleanse

- Myrkl

- Sol Healthy Live

Joint health

- Key highlights and takeaways from the report.

- Joint health vs. total supplement sales and growth, 2018-2026e

- Joint health supplement sales and growth, 2018-2026e

- Top 6 joint health supplement ingredients by market share, 2022

- Joint health supplement sales by ingredient, 2018-2026e

- Joint health supplement growth by ingredient, 2018-2026e

- Joint health supplement sales, growth and market share by channel, 2020-2022

- Jarrow Formulas SAMe 400

- GNC Tamaflex Fast Acting

- Irwin Naturals CBD + Joint Health

Menopause

- Key highlights and takeaways from the report.

- Menopause vs. total supplement sales and growth, 2018-2026e

- Menopause supplement sales and growth, 2018-2026e

- Top 6 menopause supplement ingredients by market share, 2022

- Menopause supplement sales by ingredient, 2018-2026e

- Menopause supplement growth by ingredient, 2018-2026e

- Menopause supplement sales, growth and market share by channel, 2020-2022

- Wile Perimenopause Support

- Happy Healthy Hippie Go With The Flow

- Equelle Menopause Symptom Relief

Mood and mental health

- Key highlights and takeaways from the report.

- Mood and mental health vs. total supplement sales and growth, 2018-2026e

- Mood and mental health supplement sales and growth, 2018-2026e

- Top 6 mood and mental health supplement ingredients by market share, 2022

- Mood and mental health supplement sales by ingredient, 2018-2026e

- Mood and mental health supplement growth by ingredient, 2018-2026e

- Mood and mental health supplement sales, growth and market share by channel, 2020-2022

- Roman Stress Relief

- Arrae Calm

- First Person Golden Hour

Pre- and postnatal health

- Key highlights and takeaways from the report.

- Pre- and postnatal vs. total supplement sales and growth, 2018-2026e

- Pre- and postnatal supplement sales and growth, 2018-2026e

- Top 6 pre- and postnatal supplement ingredients by market share, 2022

- Pre- and postnatal supplement sales by ingredient, 2018-2026e

- Pre- and postnatal supplement growth by ingredient, 2018-2026e

- Pre- and postnatal supplement sales, growth and market share by channel, 2020-2022

- HUM Womb Service

- The Honest Co. Love the Bump Prenatal Once Daily

- Nutrafol Postpartum Hair Growth Nutraceutical

Sexual health

- Key highlights and takeaways from the report.

- Sexual health vs. total supplement sales and growth, 2018-2026e

- Sexual health supplement sales and growth, 2018-2026e

- Top 6 sexual health supplement ingredients by market share, 2022

- Sexual health supplement sales by ingredient, 2018-2026e

- Sexual health supplement growth by ingredient, 2018-2026e

- Sexual health supplement sales, growth and market share by channel, 2020-2022

- Biochem TEST

- Ancient Nutrition Male Performance

- Pharmactive Liboost

Eye health

- Key highlights and takeaways from the report.

- Vision health vs. total supplement sales and growth, 2018-2026e

- Vision health supplement sales and growth, 2018-2026e

- Top 6 vision health supplement ingredients by market share, 2022

- Vision health supplement sales by ingredient, 2018-2026e

- Vision health supplement growth by ingredient, 2018-2026e

- Vision health supplement sales, growth and market share by channel, 2020-2022

- Bausch + Lomb Ocuvite Adult 50+

- OmniActive Lutemax 2020

- Designs for Health OcuForce Blue

Weight management

- Key highlights and takeaways from the report.

- Weight management vs. total supplement sales and growth, 2018-2026e

- Weight management supplement sales and growth, 2018-2026e

- Top 6 weight management supplement ingredients by market share, 2022

- Weight management supplement sales by ingredient, 2018-2026e

- Weight management supplement growth by ingredient, 2018-2026e

- Weight management supplement sales, growth and market share by channel, 2020-2022

- Hydroxycut Weight Loss +Women

- Glucerna Hunger Smart Shake

- Mdrive Lean

Company profiles

- Abbott Nutrition

- Adaptive Health

- Alticor (Amway)

- Ancient Nutrition

- Bausch + Lomb

- Bayer

- Better Being Co.

- Church & Dwight

- Clorox

- DSM

- Gaia Herbs

- Glanbia

- Gryphon Investors (Metagenics)

- HUM Nutrition

- Iovate Health Sciences International Inc. (a division of Xiwang Foodstuffs Company Ltd)

- Johnson & Johnson (incl. Zarbee’s)

- Kikkoman (incl. Country Life, Allergy Research Group)

- Life Extension

- Life Seasons

- Nestlé Health Science

- Nordic Naturals

- NOW Health Group

- Pharmavite

- Physician's Choice

- Procter & Gamble

- Reckitt

- Ritual

- Schwabe Group

- Swanson

- Unilever

Related content

- Home work

- Innovation unleashed

- A clinic on every corner

- Shrooms still booming

- Quantity in search of quality

- Long COVID in the long term

- Going viral

- Microbiome market is skin deep

- K2 on the brain

- In the mood

- Adolescence adjusted

- The return of the miracle drug

- Order in the disorder

Acknowledgments and definitions

- Acknowledgments

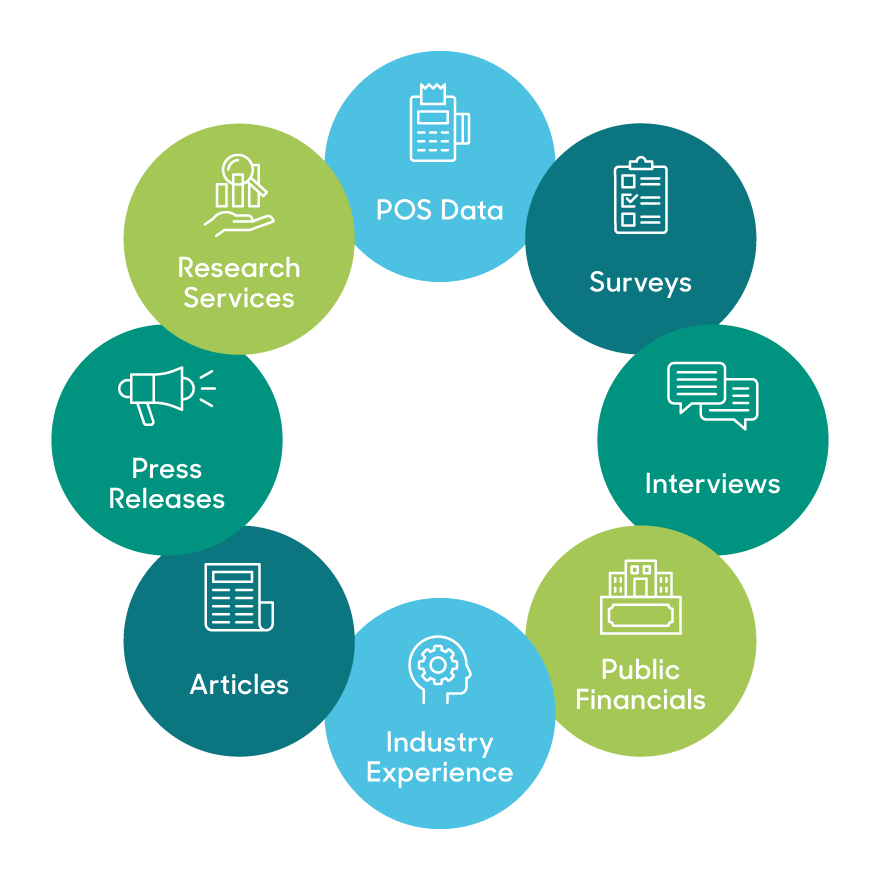

- Research methodology

- Copyright

- Definitions

The NBJ model pulls from myriad data sources, outlined in our Methodology. Critical to our outputs are partnerships with SPINS, which powers our retail data and understanding, and ClearCut Analytics, whose Amazon data supports our e-commerce projections.

Powered by

Ecommerce model supported by

Our unique methodology tells you

- what people are buying

- where they're buying it

- why they're buying it

Learn how this multi-input data model provides a comprehensive view of the industry and delivers the most accurate forecasts

Explore Our Unique ModelTestimonials

Gaia Herbs

Director, Brand Strategy

"As a brand and product development leader in the natural products industry, I have always relied on NBJ as valuable and primary sources for credible industry data and actionable insights on emerging trends."

Megafood

Director of Marketing

"NBJ Reports are used by our Exec Team, Brand/Mktg/Sales leaders to support data-based decision making and gives us industry and competitive insights."

Native Botanicals

Owner/President

"The data and information vividly reflects the trends, challenges, regulatory impacts we have experienced as we have grown into the ‘adult-hood’ of an industry we are today"

Trusted by:

Featured in: