Sales, growth, and analysis across 7 varieties of mushroom

Chaga

Cordyceps

Reishi

Lion's Mane

Turkey Tail

Maitake

Shiitake

Over 150 Data Charts

30 Company Profiles

22 Health Conditions Tracked

Raw Data + PPT Slides

Sales, growth, and analysis across these health conditions

General health

Women’s health

Men’s health

Children’s health

Gastrointestinal health

Liver health

Heart health

Healthy aging

Bone health

Joint health

Healthy sleep

Brain health

Mood and mental health

Vision

Beauty from within

Cold, flu and immunity

Pre- and postnatal

Menopause

Sexual health

Weight Management

Table of Contents

Download the Table of ContentsExecutive Overview

- Key highlights and takeaways from the report.

- Market share of top conditions, 2022

- Supplement sales by condition, 2018-2022

- Supplement sales by condition, 2023e-2026e

- Supplement growth by condition, 2018-2022

- Supplement growth by condition, 2023e-2026e

- Supplement market share by condition, 2018-2022

- Supplement market share by condition, 2023e-2026e

Beauty from within

- Key highlights and takeaways from the report.

- Beauty from within vs. total supplement sales and growth, 2018-2026e

- Beauty from within supplement sales and growth, 2018-2026e

- Top 6 beauty from within supplement ingredients by market share, 2022

- Beauty from within supplement sales by ingredient, 2018-2026e

- Beauty from within supplement growth by ingredient, 2018-2026e

- Beauty from within supplement sales, growth and market share by channel, 2020-2022

- Great Lakes Wellness Quick Dissolve Daily Beauty Collagen Peptides

- NeoCell Hair, Skin & Nails Beauty Builder Gummies

- OxyCeutics Gut to Glow

Bone health

- Key highlights and takeaways from the report.

- Bone health vs. total supplement sales and growth, 2018-2026e

- Bone health supplement sales and growth, 2018-2026e

- Top 6 bone health supplement ingredients by market share, 2022

- Bone health supplement sales by ingredient, 2018-2026e

- Bone health supplement growth by ingredient, 2018-2026e

- Bone health supplement sales, growth and market share by channel, 2020-2022

- Life Extension Bone Strength Collagen Formula

- Vital Proteins Bioactive Collagen Complex Bone and Joint Support

- Twinlab D3 1000 + K2 Dots

Brain health

- Key highlights and takeaways from the report.

- Brain health vs. total supplement sales and growth, 2018-2026e

- Brain health supplement sales and growth, 2018-2026e

- Top 6 brain health supplement ingredients by market share, 2022

- Brain health supplement sales by ingredient, 2018-2026e

- Brain health supplement growth by ingredient, 2017-2025e

- Brain health supplement sales, growth and market share by channel, 2020-2022

- Banyan Botanicals Focus Liquid Extract

- NOW Foods Triple Strength Astaxanthin

- Organifi Focus

Cold, flu and immunity

- Key highlights and takeaways from the report.

- Cold, flu, and immunity vs. total supplement sales and growth, 2018-2026e

- Cold, flu, and immunity supplement sales and growth, 2018-2026e

- Top 6 cold, flu, and immunity supplement ingredients by market share, 2022

- Cold, flu, and immunity supplement sales by ingredient, 2018-2026e

- Cold, flu, and immunity supplement growth by ingredient, 2018-2026e

- Cold, flu, and immunity supplement sales, growth and market share by channel, 2020-2022

- Aurora Nutrascience Liposomal Vitamin C

- Emergen-C Orange Support Immunity C

- LifeSeasons Clinical Immunity Quick-Start

Gastrointestinal health

- Key highlights and takeaways from the report.

- Gastrointestinal health vs. total supplement sales and growth, 2018-2026e

- Gastrointestinal health supplement sales and growth, 2018-2026e

- Top 6 gastrointestinal health supplement ingredients by market share, 2022

- Gastrointestinal health supplement sales by ingredient, 2018-2026e

- Gastrointestinal health supplement growth by ingredient, 2018-2026e

- Gastrointestinal health supplement sales, growth and market share by channel, 2020-2022

- Pendulum Butyricum

- Goli Nutrition Pre + Post + Probiotics Gummies

- NBPure Mag07

Women’s general health

- Key highlights and takeaways from the report.

- Women’s health vs. total supplement sales and growth, 2018-2026e

- Women’s health supplement sales and growth, 2018-2026e

- Top 6 women’s health supplement ingredients by market share, 2022

- Women’s health supplement sales by ingredient, 2018-2026e

- Women’s health supplement growth by ingredient, 2018-2026e

- Women’s health supplement sales, growth and market share by channel, 2020-2022

- MaryRuth’s Women’s 40+ Multi Liposomal

- Renew Life Women’s Care Gummy

- 1MD Nutrition BiomeMD for Women

Men’s general health

- Key highlights and takeaways from the report.

- Men’s health vs. total supplement sales and growth, 2018-2026e

- Men’s health supplement sales and growth, 2018-2026e

- Top 6 men’s health supplement ingredients by market share, 2022

- Men’s health supplement sales by ingredient, 2018-2026e

- Men’s health supplement growth by ingredient, 2018-2026e

- Men’s health supplement sales, growth and market share by channel, 2020-2022

- Iwi Men’s Complete Multi

- Friska Men’s Daily

- Centrum MultiGummies Men

Children’s general health

- Key highlights and takeaways from the report.

- Children’s health vs. total supplement sales and growth, 2018-2026e

- Children’s health supplement sales and growth, 2018-2026e

- Top 6 children’s health supplement ingredients by market share, 2022

- Children’s health supplement sales by ingredient, 2018-2026e

- Children’s health supplement growth by ingredient, 2018-2026e

- Children’s health supplement sales, growth and market share by channel, 2020-2022

- Hiyahealth Kids Daily Essential

- Smartypants Teen Guy Formula

- Nordic Naturals Children’s DHA

Healthy aging

- Key highlights and takeaways from the report.

- Healthy aging vs. total supplement sales and growth, 2018-2026e

- Healthy aging supplement sales and growth, 2018-2026e

- Top 6 healthy aging supplement ingredients by market share, 2022

- Healthy aging supplement sales by ingredient, 2018-2026e

- Healthy aging supplement growth by ingredient, 2018-2026e

- Healthy aging supplement sales, growth and market share by channel, 2020-2022

- Natural Factors PQQ-10

- Quiksilver Bio-Age Reversal

- Pure Encapsulations ResCu-SR

Healthy sleep

- Key highlights and takeaways from the report.

- Healthy sleep vs. total supplement sales and growth, 2018-2026e

- Healthy sleep supplement sales and growth, 2018-2026e

- Top 6 healthy sleep supplement ingredients by market share, 2022

- Healthy sleep supplement sales by ingredient, 2018-2026e

- Healthy sleep supplement growth by ingredient, 2018-2026e

- Healthy sleep supplement sales, growth and market share by channel, 2020-2022

- Neuriva Relax+Sleep

- Nue Co Sleep+

- Sandland Sleep Set

Heart health

- Key highlights and takeaways from the report.

- Heart health vs. total supplement sales and growth, 2018-2026e

- Heart health supplement sales and growth, 2018-2026e

- Top 6 heart health supplement ingredients by market share, 2022

- Heart health supplement sales by ingredient, 2018-2026e

- Heart health supplement growth by ingredient, 2018-2026e

- Heart health supplement sales, growth and market share by channel, 2020-2022

- HumanN SuperBeets Heart Chews

- Cardio Miracle

- Thorne Heart Health Complex

Liver health and detox

- Key highlights and takeaways from the report.

- Liver health and detox vs. total supplement sales and growth, 2018-2026e

- Liver health and detox supplement sales and growth, 2018-2026e

- Top 6 liver health and detox supplement ingredients by market share, 2022

- Liver health and detox supplement sales by ingredient, 2018-2026e

- Liver health and detox supplement growth by ingredient, 2018-2026e

- Liver health and detox supplement sales, growth and market share by channel, 2020-2022

- Gaia Herbs Liver Cleanse

- Myrkl

- Sol Healthy Live

Joint health

- Key highlights and takeaways from the report.

- Joint health vs. total supplement sales and growth, 2018-2026e

- Joint health supplement sales and growth, 2018-2026e

- Top 6 joint health supplement ingredients by market share, 2022

- Joint health supplement sales by ingredient, 2018-2026e

- Joint health supplement growth by ingredient, 2018-2026e

- Joint health supplement sales, growth and market share by channel, 2020-2022

- Jarrow Formulas SAMe 400

- GNC Tamaflex Fast Acting

- Irwin Naturals CBD + Joint Health

Menopause

- Key highlights and takeaways from the report.

- Menopause vs. total supplement sales and growth, 2018-2026e

- Menopause supplement sales and growth, 2018-2026e

- Top 6 menopause supplement ingredients by market share, 2022

- Menopause supplement sales by ingredient, 2018-2026e

- Menopause supplement growth by ingredient, 2018-2026e

- Menopause supplement sales, growth and market share by channel, 2020-2022

- Wile Perimenopause Support

- Happy Healthy Hippie Go With The Flow

- Equelle Menopause Symptom Relief

Mood and mental health

- Key highlights and takeaways from the report.

- Mood and mental health vs. total supplement sales and growth, 2018-2026e

- Mood and mental health supplement sales and growth, 2018-2026e

- Top 6 mood and mental health supplement ingredients by market share, 2022

- Mood and mental health supplement sales by ingredient, 2018-2026e

- Mood and mental health supplement growth by ingredient, 2018-2026e

- Mood and mental health supplement sales, growth and market share by channel, 2020-2022

- Roman Stress Relief

- Arrae Calm

- First Person Golden Hour

Pre- and postnatal health

- Key highlights and takeaways from the report.

- Pre- and postnatal vs. total supplement sales and growth, 2018-2026e

- Pre- and postnatal supplement sales and growth, 2018-2026e

- Top 6 pre- and postnatal supplement ingredients by market share, 2022

- Pre- and postnatal supplement sales by ingredient, 2018-2026e

- Pre- and postnatal supplement growth by ingredient, 2018-2026e

- Pre- and postnatal supplement sales, growth and market share by channel, 2020-2022

- HUM Womb Service

- The Honest Co. Love the Bump Prenatal Once Daily

- Nutrafol Postpartum Hair Growth Nutraceutical

Sexual health

- Key highlights and takeaways from the report.

- Sexual health vs. total supplement sales and growth, 2018-2026e

- Sexual health supplement sales and growth, 2018-2026e

- Top 6 sexual health supplement ingredients by market share, 2022

- Sexual health supplement sales by ingredient, 2018-2026e

- Sexual health supplement growth by ingredient, 2018-2026e

- Sexual health supplement sales, growth and market share by channel, 2020-2022

- Biochem TEST

- Ancient Nutrition Male Performance

- Pharmactive Liboost

Eye health

- Key highlights and takeaways from the report.

- Vision health vs. total supplement sales and growth, 2018-2026e

- Vision health supplement sales and growth, 2018-2026e

- Top 6 vision health supplement ingredients by market share, 2022

- Vision health supplement sales by ingredient, 2018-2026e

- Vision health supplement growth by ingredient, 2018-2026e

- Vision health supplement sales, growth and market share by channel, 2020-2022

- Bausch + Lomb Ocuvite Adult 50+

- OmniActive Lutemax 2020

- Designs for Health OcuForce Blue

Weight management

- Key highlights and takeaways from the report.

- Weight management vs. total supplement sales and growth, 2018-2026e

- Weight management supplement sales and growth, 2018-2026e

- Top 6 weight management supplement ingredients by market share, 2022

- Weight management supplement sales by ingredient, 2018-2026e

- Weight management supplement growth by ingredient, 2018-2026e

- Weight management supplement sales, growth and market share by channel, 2020-2022

- Hydroxycut Weight Loss +Women

- Glucerna Hunger Smart Shake

- Mdrive Lean

Company profiles

- Abbott Nutrition

- Adaptive Health

- Alticor (Amway)

- Ancient Nutrition

- Bausch + Lomb

- Bayer

- Better Being Co.

- Church & Dwight

- Clorox

- DSM

- Gaia Herbs

- Glanbia

- Gryphon Investors (Metagenics)

- HUM Nutrition

- Iovate Health Sciences International Inc. (a division of Xiwang Foodstuffs Company Ltd)

- Johnson & Johnson (incl. Zarbee’s)

- Kikkoman (incl. Country Life, Allergy Research Group)

- Life Extension

- Life Seasons

- Nestlé Health Science

- Nordic Naturals

- NOW Health Group

- Pharmavite

- Physician's Choice

- Procter & Gamble

- Reckitt

- Ritual

- Schwabe Group

- Swanson

- Unilever

Related content

- Home work

- Innovation unleashed

- A clinic on every corner

- Shrooms still booming

- Quantity in search of quality

- Long COVID in the long term

- Going viral

- Microbiome market is skin deep

- K2 on the brain

- In the mood

- Adolescence adjusted

- The return of the miracle drug

- Order in the disorder

Acknowledgments and definitions

- Acknowledgments

- Research methodology

- Copyright

- Definitions

Table of Contents

Click through each tab for an overview of each chapter and its data charts and survey questions.

Download the Table of ContentsExecutive Overview

- Key highlights and takeaways from the report. For example:

FOOD FOR THOUGHT: Mushroom supplements are poised to grow steadily over the next three years, but functional food and beverages is where the interest appears to be. In NBJ’s 2024 survey, 37% of consumers said they eat or drink functional mushroom food and beverages compared with 27% of consumers who take functional mushroom supplements.

- Mushroom supplement sales and growth, 2019-2027e

- $396.3 million mushroom supplement market share by channel, 2023

- Mushroom supplement sales and growth vs. total Herb and Botanical sales and growth, 2019-2027e

- Mushroom supplement sales by channel, 2019-2027e

- Mushroom supplement growth by channel, 2019-2027e

- Mushroom supplement market share by channel, 2019-2027e

- Level of consumer awareness about functional mushroom products

- Product categories that respondents currently purchase, by generation

- Longitudinal survey data: Likelihood of consumers purchasing functional mushroom products within 6 months

- Longitudinal survey data: Likelihood of consumers purchasing functional mushroom products within 6 months, by generation

- $396.3 million mushroom supplement market share by condition, 2023

- Mushroom supplement sales by condition, 2019-2027e

- Mushroom supplement growth by condition, 2019-2027e

- Mushroom supplement market share by condition, 2019-2027e

- Royal Mushroom Functional Gummies for Kids

- Melting Forest D-Stress Beverage

- Youtheory Mushroom Immune Complex

- Plant People WonderSleep Mushroom Gummies

- Naked Nutrition Recovery Mushroom Powder

- New Chapter Healthy Aging Reishi Mushroom Blend

- Respondents’ business types

- Categories respondents sell or sell into

- Supplement categories respondents sell or sell into

- Industry survey: Respondents that sell functional mushroom products

- Industry survey: Functional mushroom species respondents are selling, innovating in or investing in

Supplements

- Key highlights and takeaways from the report. For example:

GET WITH THE FORMULA: Consumers overwhelmingly prefer to take their mushrooms in combination formulas with other mushrooms and botanicals. These formulas are projected to bring in nearly $70 million in sales in 2024 compared with $25 million each for cordyceps and lion’s mane, the most popular single species. Combination formulas are projected to grow by about 16% annually through 2027.

- $396.3 million mushroom supplement market share by subcategory, 2023

- Mushroom supplement sales by subcategory, 2019-2027e

- Mushroom supplement growth by subcategory, 2019-2027e

- Mushroom supplement market share by subcategory, 2019-2027e

- Chaga supplement sales and growth, 2020-2027e

- Cordyceps supplement sales and growth, 2020-2027e

- Reishi supplement sales and growth, 2020-2027e

- Lion’s mane supplement sales and growth, 2020-2027e

- Turkey tail supplement sales and growth, 2020-2027e

- Maitake supplement sales and growth, 2020-2027e

- Shiitake supplement sales and growth, 2020-2027e

- Combination formulas supplement sales and growth, 2020-2027e

- Health concerns consumers use functional mushroom supplements to address

- Health concerns consumers use functional mushroom supplements to address, by generation

- Health concerns consumers use functional mushroom supplements to address, by gender

- How often consumers take functional mushroom supplements

- Need states consumers use functional mushroom supplements to address

- Need states consumers use functional mushroom supplements to address, by generation

- Need states consumers use functional mushroom supplements to address, by gender

- How long it takes for consumers to notice an effect when taking functional mushroom supplements

- Single species vs. combination formula consumption

- Where consumers first learned about functional mushroom supplements

- Consumers who took functional mushroom supplements before other types of supplements

- Consumers who took functional mushroom supplements before other types, by generation

- Functional mushroom species consumers take in supplements

- Delivery formats functional mushroom supplement users prefer

- Delivery formats functional mushroom supplement users prefer, by generation

- Vita Hustle Mood + Mind Gummies

- Mycolove Farm Turkey Tail Tincture

- Freshcap Ultimate Mushroom Complex Capsules

Functional food and beverages

- Key highlights and takeaways from the report. For example:

DRINK UP: As consumer interest in energy-boosting mushroom drinks and coffee alternatives continues to soar, consumers overwhelmingly prefer to drink their mushrooms. Protein shakes are their top choice, followed by coffee and tea, then RTD beverages.

- Types of functional mushroom food and beverage products consumers purchase

- Most popular functional mushroom species in food and beverages

- Most popular functional mushroom species in food and beverages, by generation

- Health concerns consumers use functional mushroom food and beverages to address

- Health concerns consumers use functional mushroom food and beverages to address, by generation

- Health concerns consumers use functional mushroom food and beverages to address, by gender

- How often consumers take or purchase functional mushroom food and beverage products

- Need states consumers use functional food and beverages to address

- Need states consumers use functional mushroom food and beverages to address, by generation

- Need states consumers use functional mushroom food and beverages to address, by gender

- How long it takes for consumers to notice an effect after taking functional mushroom food and beverages

- How long it takes for consumers to notice an effect after taking functional mushroom food and beverages, by generation

- Where consumers first learned about functional mushroom food and beverage products

- Host Defense Mycobrew Cocoa

- Ryze Mushroom Matcha

- Umbo Honey Walnut Pecan All-Natural Energy Bar

Psychedelic mushrooms

- Key highlights and takeaways from the report. For example:

SPORE-CAST: Functional mushrooms are benefiting from popular interest in psilocybin’s medicinal powers, which are being studied by prestigious research institutions. Though still considered a Schedule 1 drug, psilocybin constitutes a multibillion-dollar industry. Some psilocybin companies are producing and selling functional mushrooms as an additional source of revenue, and functional mushrooms like lion’s mane are often used alongside psilocybin in a process known as “stacking.”

- Longitudinal survey data: Consumer use of psychedelic mushrooms

- Consumer use of psychedelic mushrooms

- How often consumers take psychedelic mushrooms

- Longitudinal survey data: Psychedelic mushroom dosage

- Longitudinal survey data: How consumers consume psychedelic mushrooms

- Longitudinal survey data: Why consumers consume psychedelic mushrooms

- Longitudinal survey data: Consumer knowledge of psychedelic mushrooms, by generation

- Longitudinal survey data: Consumer interest in learning more about psychedelic mushrooms, by generation

- Longitudinal survey data: Of consumers who don’t currently use psychedelic mushrooms, their likelihood of using them if legal, by generation

Related content

- Opening Americans’ minds to mushrooms

- Shrooms still booming

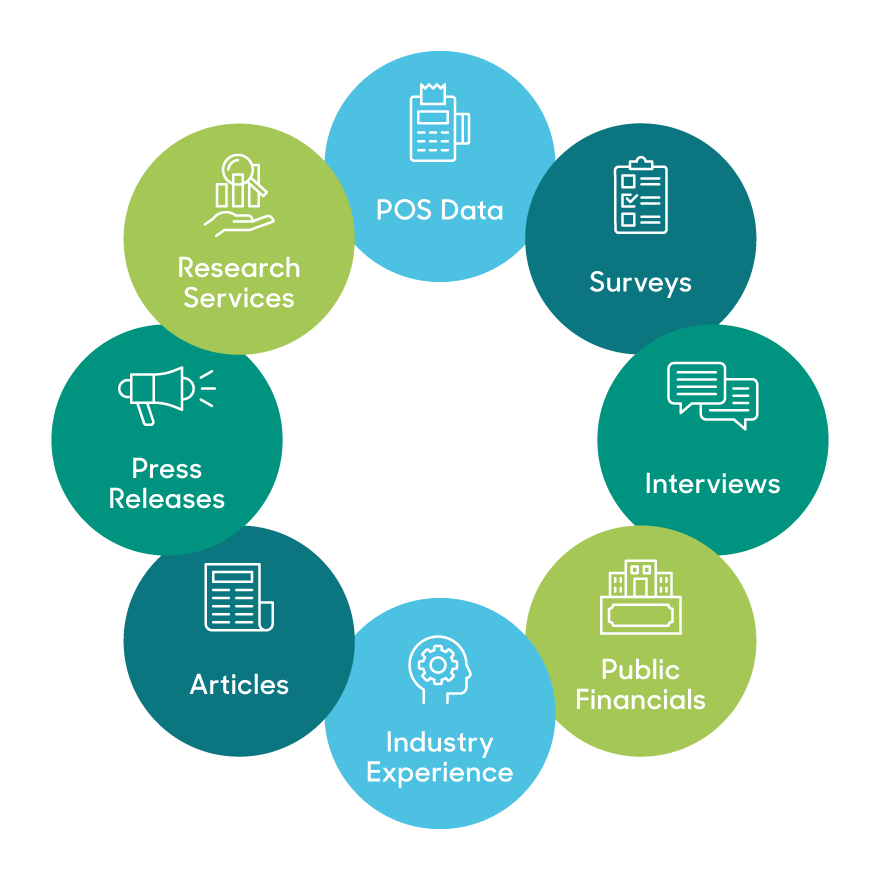

The NBJ model pulls from myriad data sources, outlined in our Methodology. Critical to our outputs are partnerships with SPINS, which powers our retail data and understanding, and ClearCut Analytics, whose Amazon data supports our e-commerce projections.

Powered by

Ecommerce model supported by

Our unique methodology tells you

- what people are buying

- where they're buying it

- why they're buying it

Learn how this multi-input data model provides a comprehensive view of the industry and delivers the most accurate forecasts

Explore Our Unique ModelTestimonials

Gaia Herbs

Director, Brand Strategy

"As a brand and product development leader in the natural products industry, I have always relied on NBJ as valuable and primary sources for credible industry data and actionable insights on emerging trends."

Megafood

Director of Marketing

"NBJ Reports are used by our Exec Team, Brand/Mktg/Sales leaders to support data-based decision making and gives us industry and competitive insights."

Native Botanicals

Owner/President

"The data and information vividly reflects the trends, challenges, regulatory impacts we have experienced as we have grown into the ‘adult-hood’ of an industry we are today"

Trusted by:

Featured in: