101 Market Sizing Charts

14 Global Companies Profiles

22 Countries & Regions Tracked

Raw Data + PPT Slides

Sales data and growth forecasts through 2025 for 22 countries and regions

United States

Western Europe

Eastern Europe

Japan

Canada

China

India

Other Asia

Mexico

Latin America

Australia and New Zealand

Middle East

Africa

Table of Contents

Download the Table of ContentsClick through each chapter for detailed list of data charts and articles.

Executive Overview

- Key highlights and takeaways from the report. For example:

The R Word: Many economists eyeing the financial markets and keeping a close watch on what governments are doing to support them are assuming a recession is on its way or already here. While the supplement industry fared well, at least in the US, during the 2008–09 financial crisis and its round-the-world ripple effect, there is no guarantee of similar results globally with factors from war to a lingering pandemic in the mix.

- Global Supplement Industry by Country or Region, 2021

- Global Supplement Industry Sales and Growth, 2017-2025e

- Global Supplement Industry Sales by Country or Region, 2017-2025e

- Global Supplement Industry Growth by Country or Region, 2017-2025e

- Global Herb and Botanical Sales and Growth, 2017-2025e

- Global Herb and Botanical Sales by Country or Region, 2017-2025e

- Global Herb and Botanical Growth by Country or Region, 2017-2025e

- Global Sports Nutrition, Meal, Homeopathic and Specialty Supplement Sales and Growth, 2017-2025e

- Global Sports Nutrition, Meal, Homeopathic and Specialty Supplement Sales by Country or Region, 2017-2025e

- Global Sports Nutrition, Meal, Homeopathic and Specialty Supplement Growth by Country or Region, 2017-2025e

- Global Vitamin and Mineral Sales and Growth, 2017-2025e

- Global Vitamin and Mineral Sales by Country or Region, 2017-2025e

- Global Vitamin and Mineral Growth by Country or Region, 2017-2025e

Asia/China

- Key highlights and takeaways from the report. For example:

Lingering Lockdowns: The coronavirus may have had its origin in China, but for a time it appeared the country’s authoritarian measures were going to stamp it out. Indeed, case counts early in the pandemic were astonishingly low, perhaps unbelievably low. A country of 1.4 billion people reported 324 cases in a day in April of 2020 when the US daily case count was pushing 200,000. And yet, as the rest of the world has learned to live with the virus, China continues its lockdowns, and depending on the region, those lockdowns can be severe.

- China - Supplement Sales by Product, 2021

- China - Supplement Sales and Growth, 2017-2025e

- China - Supplement Sales by Product, 2017-2025e

- China - Supplement Growth by Product, 2017-2025e

Asia/India

- Key highlights and takeaways from the report. For example:

Variant Volatility: India may have escaped the worst of the first round of COVID—daily deaths hovered around 50 in the spring of 2020 when the US was reporting 2,700—only to see cases shoot up a year later when Delta raged across the world’s second biggest population. That delayed effect appears to have boosted supplement sales into 2021, with one of the smaller reported drop-offs in sales growth.

- India - Supplement Sales by Product, 2021

- India - Supplement Sales and Growth, 2017-2025e

- India - Supplement Sales by Product, 2017-2025e

- India - Supplement Growth by Product, 2017-2025e

Asia/Japan and all others

- Key highlights and takeaways from the report. For example:

Maturity and Monotony: It tells us something that the 1.5% growth expected for Japan’s supplement market in 2022 would be the best in years if not for the pandemic-boosted growth in 2020 and 2021. In NBJ projections, the Japanese market hovers just above 1% through 2025.

- Japan - Supplement Sales by Product, 2021

- Japan - Supplement Sales and Growth, 2017-2025e

- Japan - Supplement Sales by Product, 2017-2025e

- Japan - Supplement Growth by Product, 2017-2025e

- Other Asian Countries - Supplement Sales by Product, 2021

- Other Asian Countries - Supplement Sales and Growth, 2017-2025e

- Other Asian Countries - Supplement Sales by Product, 2017-2025e

- Other Asian Countries - Supplement Growth by Product, 2017-2025e

Australia/New Zealand

- Key highlights and takeaways from the report. For example:

Looking Beyond China: For many years, Australia’s export model was built around sales to China, but with expanding middle classes in places like India and the Southeast Asia nations growing, Australian brands are seeking sales in new markets. Vietnam, for instance, now accounts for 10% of Australia’s supplement exports, according to Complementary Medicines Australia.

- Australia and New Zealand - Supplement Sales by Product, 2021

- Australia and New Zealand - Supplement Sales and Growth, 2017-2025e

- Australia and New Zealand - Supplement Sales by Product, 2017-2025e

- Australia and New Zealand - Supplement Growth by Product, 2017-2025e

Europe and Russia

- Key highlights and takeaways from the report. For example:

The Purse Strings: Western Europeans may be largely carrying on with commerce and lifestyle more like pre-pandemic than two years ago when much of the continent was shuttered. As Russia wields petro power, however, Europeans face the threat of higher energy bills in the coming winter. This could have a very immediate effect on the economy. How that impacts supplement sales can’t yet be known, but supplements could have a hard time squeezing through tighter purse strings.

- Total Western Europe - Supplement Sales by Product, 2021

- Total Western Europe - Supplement Sales and Growth, 2017-2025e.

- Total Western Europe - Supplement Sales by Product, 2017-2025e.

- Total Western Europe - Supplement Growth by Product, 2017-2025e.

- Belgium and Luxembourg - Supplement Sales by Product, 2021

- Belgium and Luxembourg - Supplement Sales and Growth, 2017-2025e.

- Belgium and Luxembourg - Supplement Sales by Product, 2017-2025e.

- Belgium and Luxembourg - Supplement Growth by Product, 2017-2025e.

- France - Supplement Sales by Product, 2021

- France - Supplement Sales and Growth, 2017-2025e.

- France - Supplement Sales by Product, 2017-2025e.

- France - Supplement Growth by Product, 2017-2025e.

- Germany - Supplement Sales by Product, 2021

- Germany - Supplement Sales and Growth, 2017-2025e.

- Germany - Supplement Sales by Product, 2017-2025e.

- Germany - Supplement Growth by Product, 2017-2025e.

- Italy - Supplement Sales by Product, 2021

- Italy - Supplement Sales and Growth, 2017-2025e.

- Italy - Supplement Sales by Product, 2017-2025e.

- Italy - Supplement Growth by Product, 2017-2025e.

- Netherlands - Supplement Sales by Product, 2021

- Netherlands - Supplement Sales and Growth, 2017-2025e.

- Netherlands - Supplement Sales by Product, 2017-2025e.

- Netherlands - Supplement Growth by Product, 2017-2025e.

- Scandinavia - Supplement Sales by Product, 2021

- Scandinavia - Supplement Sales and Growth, 2017-2025e.

- Scandinavia- Supplement Sales by Product, 2017-2025e.

- Scandinavia- Supplement Growth by Product, 2017-2025e.

- Spain - Supplement Sales by Product, 2021

- Spain - Supplement Sales and Growth, 2017-2025e.

- Spain - Supplement Sales by Product, 2017-2025e.

- Spain - Supplement Growth by Product, 2017-2025e.

- Switzerland and Austria - Supplement Sales by Product, 2021

- Switzerland and Austria - Supplement Sales and Growth, 2017-2025e.

- Switzerland and Austria - Supplement Sales by Product, 2017-2025e.

- Switzerland and Austria - Supplement Growth by Product, 2017-2025e.

- United Kingdom - Supplement Sales by Product, 2021

- United Kingdom - Supplement Sales and Growth, 2017-2025e.

- United Kingdom - Supplement Sales by Product, 2017-2025e.

- United Kingdom - Supplement Growth by Product, 2017-2025e.

- Other Western European Countries - Supplement Sales by Product, 2021

- Other Western European Countries - Supplement Sales and Growth, 2017-2025e.

- Other Western European Countries - Supplement Sales by Product, 2017-2025e.

- Other Western European Countries - Supplement Growth by Product, 2017-2025e.

- Eastern Europe and Russia - Supplement Sales by Product, 2021

- Eastern Europe and Russia - Supplement Sales and Growth, 2017-2025e.

- Eastern Europe and Russia - Supplement Sales by Product, 2017-2025e.

- Eastern Europe and Russia - Supplement Growth by Product, 2017-2025e.

Latin America

- Key highlights and takeaways from the report. For example:

Resiliency Matter: Watching sales growth drop by more than half, as it did for supplements in 2021, is rarely a cause for celebration. But however much growth has fallen from its COVID-boosted high, the readjustment looks gentler than we’re seeing in other spots. Growth for 2022 is projected at 9.3%, with a market predicted to end the year at $16.16 billion.

- Latin America - Supplement Sales by Product, 2021

- Latin America - Supplement Sales and Growth, 2017-2025e

- Latin America - Supplement Sales by Product, 2017-2025e

- Latin America - Supplement Growth by Product, 2017-2025e

- Mexico - Supplement Sales by Product, 2021

- Mexico - Supplement Sales and Growth, 2017-2025e

- Mexico - Supplement Sales by Product, 2017-2025e

- Mexico - Supplement Growth by Product, 2017-2025e

Middle East and Africa

- Key highlights and takeaways from the report. For example:

VMS Veers: Sales of Vitamins and Minerals in Africa soared during the pandemic, easily outpacing the other categories to hit 15.1% growth in 2020 and holding on to 9.8% growth to reach $908 million in sales in 2021. But that spike is over. The Vitamins and minerals market is expected to normalize at 1.8% growth in 2023.

- Middle East - Supplement Sales by Product, 2021

- Middle East - Supplement Sales and Growth, 2017-2025e

- Middle East - Supplement Sales by Product, 2017-2025e

- Middle East - Supplement Growth by Product, 2017-2025e

- Africa - Supplement Sales by Product, 2021

- Africa - Supplement Sales and Growth, 2017-2025e

- Africa - Supplement Sales by Product, 2017-2025e

- Africa - Supplement Growth by Product, 2017-2025e

United States and Canada

- Key highlights and takeaways from the report. For example:

A Billion Here or There: By 2025, NBJ projects the Canadian supplement market will be $877 million larger than it was in 2017. In contrast, the US market will be $26.5 billion larger. The US is obviously a much larger market, but even from that vastly larger base, it marches at a faster pace.

- United States - Supplement Sales by Product, 2021

- United States - Supplement Sales and Growth, 2017-2025e

- United States - Supplement Sales by Product, 2017-2025e

- United States - Supplement Growth by Product, 2017-2025e

- Canada - Supplement Sales by Product, 2021

- Canada - Supplement Sales and Growth, 2017-2025e

- Canada - Supplement Sales by Product, 2017-2025e

- Canada - Supplement Growth by Product, 2017-2025e

Company Profiles

- Alticor (Amway, Nutrilite)

- Bayer

- Blackmores

- Glanbia

- GNC

- GSK Consumer Healthcare

- Herbalife Nutrition Ltd

- Iovate Health Sciences International Inc. (a division of Xiwang Foodstuffs Company Ltd)

- Jamieson

- Nestlé Health Science

- Nu Skin Enterprises

- Pharmavite

- Schwabe Group

- USANA

Related content

- The Currency Challenge

- Appropriate appropriation

- Supplements hitting their stride

- The China update

- China’s supplement industry

- The Indian consumer market: Growing against challenges

- The state of Japan’s supplements industry

- Strong and sustainable

- Conditional formatting

- What happens in Europe

- Challenges and trends

- Meeting challenges with change

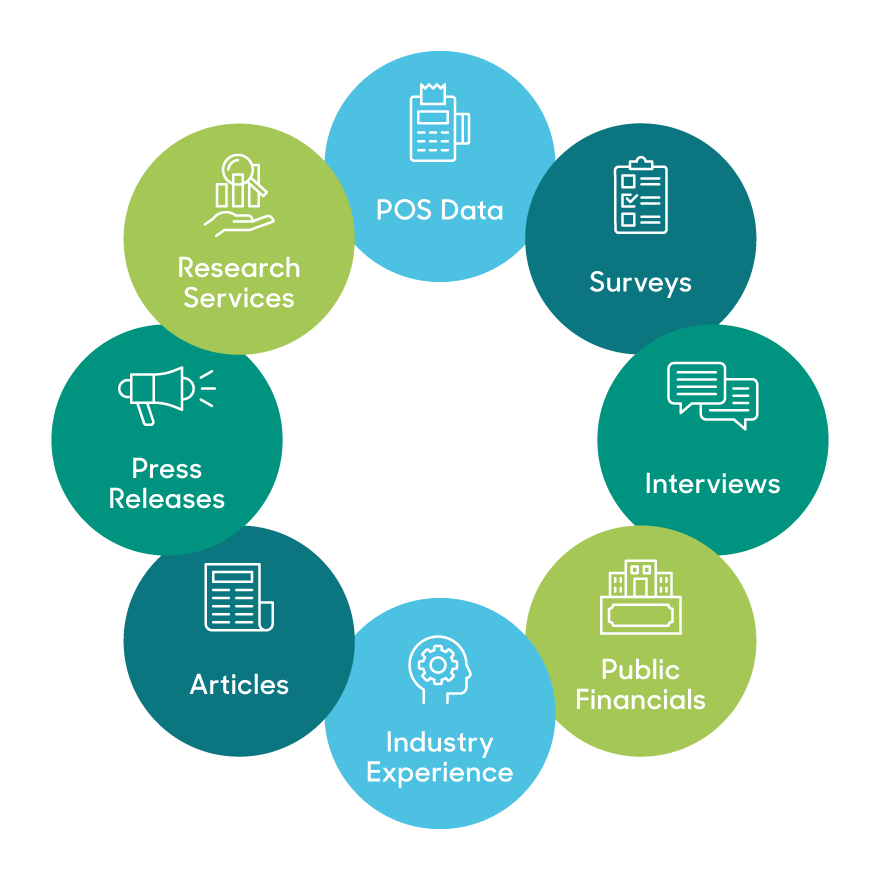

The NBJ model pulls from myriad data sources, outlined in our Methodology. Critical to our outputs are partnerships with SPINS, which powers our retail data and understanding, and ClearCut Analytics, whose Amazon data supports our e-commerce projections.

Powered by

Ecommerce model supported by

Our unique methodology tells you

- what people are buying

- where they're buying it

- why they're buying it

Learn how this multi-input data model provides a comprehensive view of the industry and delivers the most accurate forecasts

Explore Our Unique ModelTestimonials

Gaia Herbs

Director, Brand Strategy

"As a brand and product development leader in the natural products industry, I have always relied on NBJ as valuable and primary sources for credible industry data and actionable insights on emerging trends."

Megafood

Director of Marketing

"NBJ Reports are used by our Exec Team, Brand/Mktg/Sales leaders to support data-based decision making and gives us industry and competitive insights."

Native Botanicals

Owner/President

"The data and information vividly reflects the trends, challenges, regulatory impacts we have experienced as we have grown into the ‘adult-hood’ of an industry we are today"

Trusted by:

Featured in: