Over 100 Data Charts

22 Countries & Regions

Preliminary 2023 Sales & Growth Data

Raw Data + PPT Slides

Table of Contents

Click through each chapter for detailed list of data charts, articles, and a free preview of chapter's Top Thoughts.

Download the Table of ContentsExecutive Overview

- Key highlights and takeaways from the report. For example:

EMERGING MOMENTUM : Approaching mid-decade, emerging markets are clearly where the action is. Latin America topped the growth curves in 2022 with 10.6% growth. Mexico leads in 2023 with 10.8%, and India finds its place in the top three at 7.6%. As these markets scale up, the numbers matter more and more. Collectively, the three regions account for $1 out of every $6 spent on supplements.

- Global supplement industry by country, 2023p

- Global supplement industry sales and growth, 2018-2026e

- Global supplement industry sales by country, 2018-2026e

- Global supplement industry growth by country, 2018-2026e

- Global supplement industry market share by country, 2018-2026e

- Global herb and botanical sales and growth, 2018-2026e

- Global herb and botanical sales by country, 2018-2026e

- Global herb and botanical growth by country, 2018-2026e

- Global herb and botanical market share by country, 2018-2026e

- Global sports nutrition, meal, homeopathic, and specialty supplement sales and growth, 2018-2026e

- Global sports nutrition, meal, homeopathic, and specialty supplement sales by country, 2018-2026e

- Global sports nutrition, meal, homeopathic, and specialty supplement growth by country, 2018-2026e

- Global sports nutrition, meal, homeopathic, and specialty supplement market share by country, 2018-2026e

- Global sports nutrition, meal, homeopathic, and specialty supplement market share by country, 2018-2026e

- Global vitamin and mineral sales and growth, 2018-2026e

- Global vitamin and mineral sales by country, 2018-2026e

- Global vitamin and mineral growth by country, 2018-2026e

- Global vitamin and mineral market share by country, 2018-2026e

- Top 15 global companies by VMS sales, 2022

Asia/China

- Key highlights and takeaways from the report. For example:

PERFORMANCE AND PERSPECTIVE: China may have been the economic miracle of the last 30 years, but even miracles come with an expiration date. We shouldn’t exaggerate that expiration date—the 3% GDP growth in 2022 is substantially better than the 1.8% economists clocked for the U.S.—but the challenges for the superpower are more complex than a GDP stepdown might suggest, with a massive downturn in real estate raising questions about how solid the foundation of that miracle may be.

- China supplement sales by product, 2023p

- China supplement sales and growth, 2018-2026e

- China supplement sales by product, 2018-2026e

- China supplement growth by product, 2018-2026e

Asia/India

- Key highlights and takeaways from the report. For example:

UNEVEN RETURN: In 2020, the Herbs and Botanicals category was the clear growth winner in India, even as Vitamins and Minerals shot up faster in most other countries in response to the pandemic. In 2023, however, the combined Sports, Meal Replacement, Homeopathy and Specialty Ingredient market is growing more than twice as fast as either Vitamins and Minerals or Herbs and Botanicals. That lead persists throughout the forecast period.

- India supplement sales by product, 2023p

- India supplement sales and growth, 2018-2026e

- India supplement sales by product, 2018-2026e

- India supplement growth by product, 2018-2026e

Asia: Japan and Rest of Asia

- Key highlights and takeaways from the report. For example:

LOSS LEADER: Japan stands out as only one of three countries or regions in this report to post an outright decline for 2022. What might be more discouraging is how short a flip it took to get from normal growth patterns into a decline. It hasn’t just lingered in the single digits. It is instead perpetually trapped in the low single digits.

- Japan supplement sales by product, 2023p

- Japan supplement sales and growth, 2018-2026e

- Japan supplement sales by product, 2018-2026e

- Japan supplement growth by product, 2018-2026e

- Rest of Asia supplement sales by product, 2023p

- Rest of Asia supplement sales and growth, 2018-2026e

- Rest of Asia supplement sales by product, 2018-2026e

- Rest of Asia supplement growth by product, 2018-2026e

Australia/New Zealand

- Key highlights and takeaways from the report. For example:

OFF AXIS: For years, NBJ and supplement insiders have talked about an Aussie-China Axis with the Australian supplement industry enjoying popularity with Chinese consumers, both from Chinese tourists and via cross-border e-commerce. Given travel restrictions during the COVID pandemic and current economic troubles in China, that axis has tilted, and the new tilt may be a challenge for Australian brands.

- Australia and New Zealand supplement sales by product, 2023p

- Australia and New Zealand supplement sales and growth, 2018-2026e

- Australia and New Zealand supplement sales by product, 2018-2026e

- Australia and New Zealand supplement growth by product, 2018-2026e

Europe and Russia

- Key highlights and takeaways from the report. For example:

STICKER SHOCKED: Americans are very upset about inflation, particularly rising prices for food, but all they need to do is look at Europe to know how good they have it. In Germany, food price inflation passed 21% early in the year. France saw an 11.2% jump in August. The annual U.S. rate in August for food-at-home was just 3%. European consumers aren’t walking away from supplements, but it must be assumed that inflation is doing nothing good for the nutrition industry.

- Belgium and Luxembourg supplement sales by product, 2023p

- Belgium and Luxembourg supplement sales and growth, 2018-2026e

- Belgium and Luxembourg supplement sales by product, 2018-2026e

- Belgium and Luxembourg supplement growth by product, 2018-2026e

- France supplement sales by product, 2023p

- France supplement sales and growth, 2018-2026e

- France supplement sales by product, 2018-2026e

- France supplement growth by product, 2018-2026e

- Germany supplement sales by product, 2023p

- Germany supplement sales and growth, 2018-2026e

- Germany supplement sales by product, 2018-2026e

- Germany supplement growth by product, 2018-2026e

- Italy supplement sales by product, 2023p

- Italy supplement sales and growth, 2018-2026e

- Italy supplement sales by product, 2018-2026e

- Italy supplement growth by product, 2018-2026e

- Netherlands supplement sales by product, 2023p

- Netherlands supplement sales and growth, 2018-2026e

- Netherlands supplement sales by product, 2018-2026e

- Netherlands supplement growth by product, 2018-2026e

- Scandinavia supplement sales by product, 2023p

- Scandinavia supplement sales and growth, 2018-2026e

- Scandinavia supplement sales by product, 2018-2026e

- Scandinavia supplement growth by product, 2018-2026e

- Spain supplement sales by product, 2023p

- Spain supplement sales and growth, 2018-2026e

- Spain supplement sales by product, 2018-2026e

- Spain supplement growth by product, 2018-2026e

- Switzerland and Austria supplement sales by product, 2023p

- Switzerland and Austria supplement sales and growth, 2018-2026e

- Switzerland and Austria supplement sales by product, 2018-2026e

- Switzerland and Austria supplement growth by product, 2018-2026e

- United Kingdom supplement sales by product, 2023p

- United Kingdom supplement sales and growth, 2018-2026e

- United Kingdom supplement sales by product, 2018-2026e

- United Kingdom supplement growth by product, 2018-2026e

- Other Western Europe supplement sales by product, 2023p

- Other Western Europe supplement sales and growth, 2018-2026e

- Other Western Europe supplement sales by product, 2018-2026e

- Other Western Europe supplement growth by product, 2018-2026e

- Total Western Europe supplement sales by product, 2023p

- Total Western Europe supplement sales and growth, 2018-2026e

- Total Western Europe supplement sales by product, 2018-2026e

- Total Western Europe supplement growth by product, 2018-2026e

- Eastern Europe and Russia supplement sales by product, 2023p

- Eastern Europe and Russia supplement sales and growth, 2018-2026e

- Eastern Europe and Russia supplement sales by product, 2018-2026e

- Eastern Europe and Russia supplement growth by product, 2018-2026e

Latin America

- Key highlights and takeaways from the report. For example:

MAINTAINING MOMENTUM: Mexico and Central/South America saw some of the biggest COVID bumps of all international markets in 2020, but they’re not seeing the kind of correction other markets have experienced. Growth slowed in 2021, but both Latin America and Mexico are at or near double digits in 2023.

- Latin America supplement sales by product, 2023p

- Latin America supplement sales and growth, 2018-2026e

- Latin America supplement sales by product, 2018-2026e

- Latin America supplement growth by product, 2018-2026e

- Mexico supplement sales by product, 2023p

- Mexico supplement sales and growth, 2018-2026e

- Mexico supplement sales by product, 2018-2026e

- Mexico supplement growth by product, 2018-2026e

Middle East and Africa

- Key highlights and takeaways from the report. For example:

SPEED BUMP: In both Africa and the Middle East, 2022 was a disastrous year for supplement sales. It’s not just that both fell from high single-digit growth in 2021 to low single digits for Middle East and near-flat for Africa; it’s that 2022 marks a break in a very promising pattern. Growth had been strong leading into the pandemic and barely dropped in 2021. Much of this is tied to inflation, currency exchange and economic conditions, but such a shift demands attention. The good news is that brands are telling NBJ the Middle East looks promising in 2023.

- Middle East supplement sales by product, 2023p

- Middle East supplement sales and growth, 2018-2026e

- Middle East supplement sales by product, 2018-2026e

- Middle East supplement growth by product, 2018-2026e

- Africa supplement sales by product, 2023p

- Africa supplement sales and growth, 2018-2026e

- Africa supplement sales by product, 2018-2026e

- Africa supplement growth by product, 2018-2026e

United States and Canada

- Key highlights and takeaways from the report. For example:

SHARED CONCERNS: The U.S. and Canada share more than a continent and a 5,500-mile border, but what the two markets share regarding supplements could be called unique. Canada did not see the COVID bump the U.S. experienced and has since watched sales fall even further. Inflation is affecting both countries, but the drag on sales looks harsher to the north. Brands in both countries are targeting international markets for growth.

- United States supplement sales by product, 2023p

- United States supplement sales and growth, 2018-2026e

- United States supplement sales by product, 2018-2026e

- United States supplement growth by product, 2018-2026e

- Canada supplement sales by product, 2023p

- Canada supplement sales and growth, 2018-2026e

- Canada supplement sales by product, 2018-2026e

- Canada supplement growth by product, 2018-2026e

Company Profiles

- Abbott Nutrition

- Alticor (Amway)

- Bayer

- Blackmores

- Glanbia

- GNC

- Haleon (formerly GSK)

- Herbalife Nutrition Ltd

- Jamieson

- Nestlé Health Science

- Nu Skin

- Schwabe Group

- USANA

Over 150 Data Charts

30 Company Profiles

22 Health Conditions Tracked

Raw Data + PPT Slides

Sales, growth, and analysis across these health conditions

General health

Women’s health

Men’s health

Children’s health

Gastrointestinal health

Liver health

Heart health

Healthy aging

Bone health

Joint health

Healthy sleep

Brain health

Mood and mental health

Vision

Beauty from within

Cold, flu and immunity

Pre- and postnatal

Menopause

Sexual health

Weight Management

Table of Contents

Download the Table of ContentsExecutive Overview

- Key highlights and takeaways from the report.

- Market share of top conditions, 2022

- Supplement sales by condition, 2018-2022

- Supplement sales by condition, 2023e-2026e

- Supplement growth by condition, 2018-2022

- Supplement growth by condition, 2023e-2026e

- Supplement market share by condition, 2018-2022

- Supplement market share by condition, 2023e-2026e

Beauty from within

- Key highlights and takeaways from the report.

- Beauty from within vs. total supplement sales and growth, 2018-2026e

- Beauty from within supplement sales and growth, 2018-2026e

- Top 6 beauty from within supplement ingredients by market share, 2022

- Beauty from within supplement sales by ingredient, 2018-2026e

- Beauty from within supplement growth by ingredient, 2018-2026e

- Beauty from within supplement sales, growth and market share by channel, 2020-2022

- Great Lakes Wellness Quick Dissolve Daily Beauty Collagen Peptides

- NeoCell Hair, Skin & Nails Beauty Builder Gummies

- OxyCeutics Gut to Glow

Bone health

- Key highlights and takeaways from the report.

- Bone health vs. total supplement sales and growth, 2018-2026e

- Bone health supplement sales and growth, 2018-2026e

- Top 6 bone health supplement ingredients by market share, 2022

- Bone health supplement sales by ingredient, 2018-2026e

- Bone health supplement growth by ingredient, 2018-2026e

- Bone health supplement sales, growth and market share by channel, 2020-2022

- Life Extension Bone Strength Collagen Formula

- Vital Proteins Bioactive Collagen Complex Bone and Joint Support

- Twinlab D3 1000 + K2 Dots

Brain health

- Key highlights and takeaways from the report.

- Brain health vs. total supplement sales and growth, 2018-2026e

- Brain health supplement sales and growth, 2018-2026e

- Top 6 brain health supplement ingredients by market share, 2022

- Brain health supplement sales by ingredient, 2018-2026e

- Brain health supplement growth by ingredient, 2017-2025e

- Brain health supplement sales, growth and market share by channel, 2020-2022

- Banyan Botanicals Focus Liquid Extract

- NOW Foods Triple Strength Astaxanthin

- Organifi Focus

Cold, flu and immunity

- Key highlights and takeaways from the report.

- Cold, flu, and immunity vs. total supplement sales and growth, 2018-2026e

- Cold, flu, and immunity supplement sales and growth, 2018-2026e

- Top 6 cold, flu, and immunity supplement ingredients by market share, 2022

- Cold, flu, and immunity supplement sales by ingredient, 2018-2026e

- Cold, flu, and immunity supplement growth by ingredient, 2018-2026e

- Cold, flu, and immunity supplement sales, growth and market share by channel, 2020-2022

- Aurora Nutrascience Liposomal Vitamin C

- Emergen-C Orange Support Immunity C

- LifeSeasons Clinical Immunity Quick-Start

Gastrointestinal health

- Key highlights and takeaways from the report.

- Gastrointestinal health vs. total supplement sales and growth, 2018-2026e

- Gastrointestinal health supplement sales and growth, 2018-2026e

- Top 6 gastrointestinal health supplement ingredients by market share, 2022

- Gastrointestinal health supplement sales by ingredient, 2018-2026e

- Gastrointestinal health supplement growth by ingredient, 2018-2026e

- Gastrointestinal health supplement sales, growth and market share by channel, 2020-2022

- Pendulum Butyricum

- Goli Nutrition Pre + Post + Probiotics Gummies

- NBPure Mag07

Women’s general health

- Key highlights and takeaways from the report.

- Women’s health vs. total supplement sales and growth, 2018-2026e

- Women’s health supplement sales and growth, 2018-2026e

- Top 6 women’s health supplement ingredients by market share, 2022

- Women’s health supplement sales by ingredient, 2018-2026e

- Women’s health supplement growth by ingredient, 2018-2026e

- Women’s health supplement sales, growth and market share by channel, 2020-2022

- MaryRuth’s Women’s 40+ Multi Liposomal

- Renew Life Women’s Care Gummy

- 1MD Nutrition BiomeMD for Women

Men’s general health

- Key highlights and takeaways from the report.

- Men’s health vs. total supplement sales and growth, 2018-2026e

- Men’s health supplement sales and growth, 2018-2026e

- Top 6 men’s health supplement ingredients by market share, 2022

- Men’s health supplement sales by ingredient, 2018-2026e

- Men’s health supplement growth by ingredient, 2018-2026e

- Men’s health supplement sales, growth and market share by channel, 2020-2022

- Iwi Men’s Complete Multi

- Friska Men’s Daily

- Centrum MultiGummies Men

Children’s general health

- Key highlights and takeaways from the report.

- Children’s health vs. total supplement sales and growth, 2018-2026e

- Children’s health supplement sales and growth, 2018-2026e

- Top 6 children’s health supplement ingredients by market share, 2022

- Children’s health supplement sales by ingredient, 2018-2026e

- Children’s health supplement growth by ingredient, 2018-2026e

- Children’s health supplement sales, growth and market share by channel, 2020-2022

- Hiyahealth Kids Daily Essential

- Smartypants Teen Guy Formula

- Nordic Naturals Children’s DHA

Healthy aging

- Key highlights and takeaways from the report.

- Healthy aging vs. total supplement sales and growth, 2018-2026e

- Healthy aging supplement sales and growth, 2018-2026e

- Top 6 healthy aging supplement ingredients by market share, 2022

- Healthy aging supplement sales by ingredient, 2018-2026e

- Healthy aging supplement growth by ingredient, 2018-2026e

- Healthy aging supplement sales, growth and market share by channel, 2020-2022

- Natural Factors PQQ-10

- Quiksilver Bio-Age Reversal

- Pure Encapsulations ResCu-SR

Healthy sleep

- Key highlights and takeaways from the report.

- Healthy sleep vs. total supplement sales and growth, 2018-2026e

- Healthy sleep supplement sales and growth, 2018-2026e

- Top 6 healthy sleep supplement ingredients by market share, 2022

- Healthy sleep supplement sales by ingredient, 2018-2026e

- Healthy sleep supplement growth by ingredient, 2018-2026e

- Healthy sleep supplement sales, growth and market share by channel, 2020-2022

- Neuriva Relax+Sleep

- Nue Co Sleep+

- Sandland Sleep Set

Heart health

- Key highlights and takeaways from the report.

- Heart health vs. total supplement sales and growth, 2018-2026e

- Heart health supplement sales and growth, 2018-2026e

- Top 6 heart health supplement ingredients by market share, 2022

- Heart health supplement sales by ingredient, 2018-2026e

- Heart health supplement growth by ingredient, 2018-2026e

- Heart health supplement sales, growth and market share by channel, 2020-2022

- HumanN SuperBeets Heart Chews

- Cardio Miracle

- Thorne Heart Health Complex

Liver health and detox

- Key highlights and takeaways from the report.

- Liver health and detox vs. total supplement sales and growth, 2018-2026e

- Liver health and detox supplement sales and growth, 2018-2026e

- Top 6 liver health and detox supplement ingredients by market share, 2022

- Liver health and detox supplement sales by ingredient, 2018-2026e

- Liver health and detox supplement growth by ingredient, 2018-2026e

- Liver health and detox supplement sales, growth and market share by channel, 2020-2022

- Gaia Herbs Liver Cleanse

- Myrkl

- Sol Healthy Live

Joint health

- Key highlights and takeaways from the report.

- Joint health vs. total supplement sales and growth, 2018-2026e

- Joint health supplement sales and growth, 2018-2026e

- Top 6 joint health supplement ingredients by market share, 2022

- Joint health supplement sales by ingredient, 2018-2026e

- Joint health supplement growth by ingredient, 2018-2026e

- Joint health supplement sales, growth and market share by channel, 2020-2022

- Jarrow Formulas SAMe 400

- GNC Tamaflex Fast Acting

- Irwin Naturals CBD + Joint Health

Menopause

- Key highlights and takeaways from the report.

- Menopause vs. total supplement sales and growth, 2018-2026e

- Menopause supplement sales and growth, 2018-2026e

- Top 6 menopause supplement ingredients by market share, 2022

- Menopause supplement sales by ingredient, 2018-2026e

- Menopause supplement growth by ingredient, 2018-2026e

- Menopause supplement sales, growth and market share by channel, 2020-2022

- Wile Perimenopause Support

- Happy Healthy Hippie Go With The Flow

- Equelle Menopause Symptom Relief

Mood and mental health

- Key highlights and takeaways from the report.

- Mood and mental health vs. total supplement sales and growth, 2018-2026e

- Mood and mental health supplement sales and growth, 2018-2026e

- Top 6 mood and mental health supplement ingredients by market share, 2022

- Mood and mental health supplement sales by ingredient, 2018-2026e

- Mood and mental health supplement growth by ingredient, 2018-2026e

- Mood and mental health supplement sales, growth and market share by channel, 2020-2022

- Roman Stress Relief

- Arrae Calm

- First Person Golden Hour

Pre- and postnatal health

- Key highlights and takeaways from the report.

- Pre- and postnatal vs. total supplement sales and growth, 2018-2026e

- Pre- and postnatal supplement sales and growth, 2018-2026e

- Top 6 pre- and postnatal supplement ingredients by market share, 2022

- Pre- and postnatal supplement sales by ingredient, 2018-2026e

- Pre- and postnatal supplement growth by ingredient, 2018-2026e

- Pre- and postnatal supplement sales, growth and market share by channel, 2020-2022

- HUM Womb Service

- The Honest Co. Love the Bump Prenatal Once Daily

- Nutrafol Postpartum Hair Growth Nutraceutical

Sexual health

- Key highlights and takeaways from the report.

- Sexual health vs. total supplement sales and growth, 2018-2026e

- Sexual health supplement sales and growth, 2018-2026e

- Top 6 sexual health supplement ingredients by market share, 2022

- Sexual health supplement sales by ingredient, 2018-2026e

- Sexual health supplement growth by ingredient, 2018-2026e

- Sexual health supplement sales, growth and market share by channel, 2020-2022

- Biochem TEST

- Ancient Nutrition Male Performance

- Pharmactive Liboost

Eye health

- Key highlights and takeaways from the report.

- Vision health vs. total supplement sales and growth, 2018-2026e

- Vision health supplement sales and growth, 2018-2026e

- Top 6 vision health supplement ingredients by market share, 2022

- Vision health supplement sales by ingredient, 2018-2026e

- Vision health supplement growth by ingredient, 2018-2026e

- Vision health supplement sales, growth and market share by channel, 2020-2022

- Bausch + Lomb Ocuvite Adult 50+

- OmniActive Lutemax 2020

- Designs for Health OcuForce Blue

Weight management

- Key highlights and takeaways from the report.

- Weight management vs. total supplement sales and growth, 2018-2026e

- Weight management supplement sales and growth, 2018-2026e

- Top 6 weight management supplement ingredients by market share, 2022

- Weight management supplement sales by ingredient, 2018-2026e

- Weight management supplement growth by ingredient, 2018-2026e

- Weight management supplement sales, growth and market share by channel, 2020-2022

- Hydroxycut Weight Loss +Women

- Glucerna Hunger Smart Shake

- Mdrive Lean

Company profiles

- Abbott Nutrition

- Adaptive Health

- Alticor (Amway)

- Ancient Nutrition

- Bausch + Lomb

- Bayer

- Better Being Co.

- Church & Dwight

- Clorox

- DSM

- Gaia Herbs

- Glanbia

- Gryphon Investors (Metagenics)

- HUM Nutrition

- Iovate Health Sciences International Inc. (a division of Xiwang Foodstuffs Company Ltd)

- Johnson & Johnson (incl. Zarbee’s)

- Kikkoman (incl. Country Life, Allergy Research Group)

- Life Extension

- Life Seasons

- Nestlé Health Science

- Nordic Naturals

- NOW Health Group

- Pharmavite

- Physician's Choice

- Procter & Gamble

- Reckitt

- Ritual

- Schwabe Group

- Swanson

- Unilever

Related content

- Home work

- Innovation unleashed

- A clinic on every corner

- Shrooms still booming

- Quantity in search of quality

- Long COVID in the long term

- Going viral

- Microbiome market is skin deep

- K2 on the brain

- In the mood

- Adolescence adjusted

- The return of the miracle drug

- Order in the disorder

Acknowledgments and definitions

- Acknowledgments

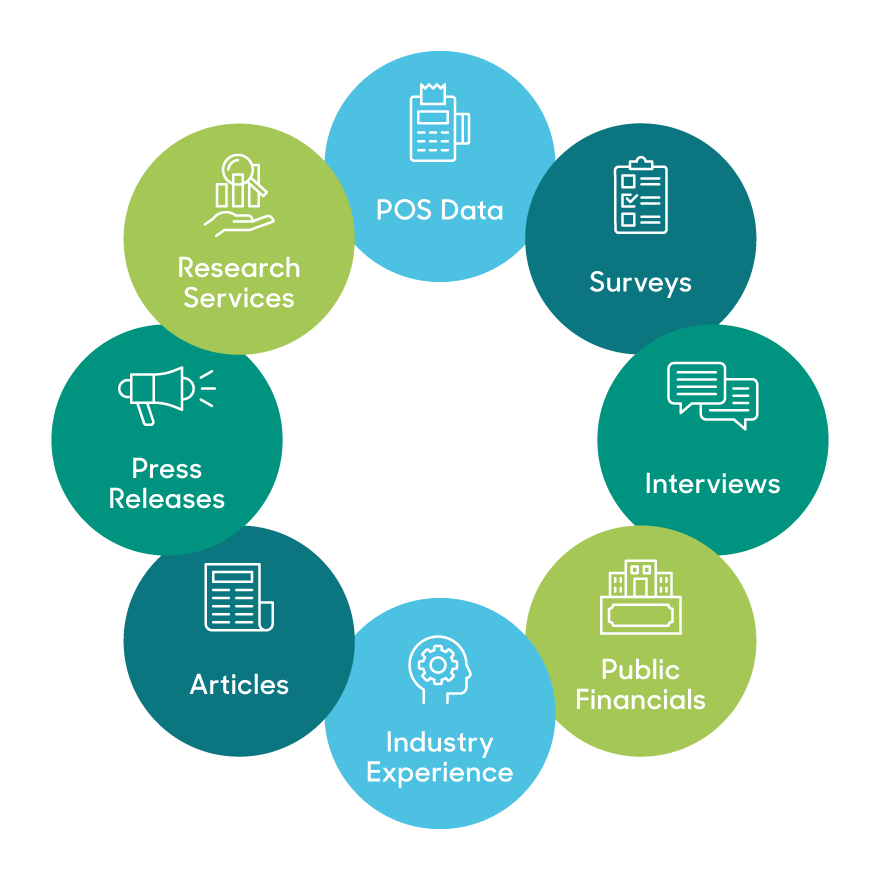

- Research methodology

- Copyright

- Definitions

The NBJ model pulls from myriad data sources, outlined in our Methodology. Critical to our outputs are partnerships with SPINS, which powers our retail data and understanding, and ClearCut Analytics, whose Amazon data supports our e-commerce projections.

Powered by

Ecommerce model supported by

Our unique methodology tells you

- what people are buying

- where they're buying it

- why they're buying it

Learn how this multi-input data model provides a comprehensive view of the industry and delivers the most accurate forecasts

Explore Our Unique ModelTestimonials

Gaia Herbs

Director, Brand Strategy

"As a brand and product development leader in the natural products industry, I have always relied on NBJ as valuable and primary sources for credible industry data and actionable insights on emerging trends."

Megafood

Director of Marketing

"NBJ Reports are used by our Exec Team, Brand/Mktg/Sales leaders to support data-based decision making and gives us industry and competitive insights."

Native Botanicals

Owner/President

"The data and information vividly reflects the trends, challenges, regulatory impacts we have experienced as we have grown into the ‘adult-hood’ of an industry we are today"

Trusted by:

Featured in: