Exclusive Data Charts

See hightlights on top claims

An Expansion on Categories Observed

Enjoy a deeper dive into key categories

Current and Future Target Users

Survey's include an audience of current users and targeted future users

Table of Contents

Click through each tab for an overview of each chapter and its data charts and survey questions.

Download the Table of ContentsExecutive Overview

Sports food and beverage: Functional beverages and bars

Sports food and beverage: Hydration and energy

Sports supplements

Weight management supplements

Sales channels

Appendix

Company profiles

Related Content

Acknowledgments and Definitions

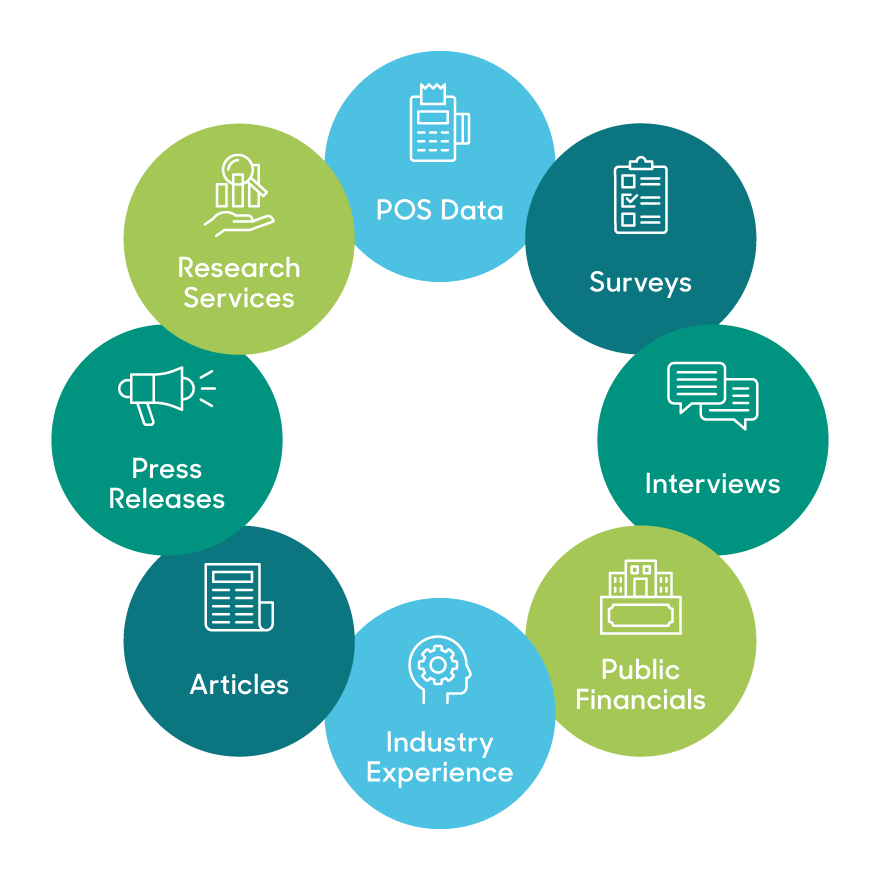

The NBJ model pulls from myriad data sources, outlined in our Methodology. Critical to our outputs are partnerships with SPINS, which powers our retail data and understanding, and ClearCut Analytics, whose Amazon data supports our e-commerce projections.

Powered by

Ecommerce model supported by

Our unique methodology tells you

- what people are buying

- where they're buying it

- why they're buying it

Learn how this multi-input data model provides a comprehensive view of the industry and delivers the most accurate forecasts

Explore Our Unique ModelTestimonials

Gaia Herbs

Director, Brand Strategy

"As a brand and product development leader in the natural products industry, I have always relied on NBJ as valuable and primary sources for credible industry data and actionable insights on emerging trends."

Megafood

Director of Marketing

"NBJ Reports are used by our Exec Team, Brand/Mktg/Sales leaders to support data-based decision making and gives us industry and competitive insights."

Native Botanicals

Owner/President

"The data and information vividly reflects the trends, challenges, regulatory impacts we have experienced as we have grown into the ‘adult-hood’ of an industry we are today"

Trusted by:

Featured in: